Over the course of 2025, the global box office hasn’t always delivered progress. Even less than usual from globally successful US-releases. In December, this changed. ZOOTOPIA 2 and AVATAR: FIRE AND ASH were leading the box office around the world, becoming the two highest-grossing global US movies of the year, which generated a combined $1.8 billion within December, just over half (52%) of the month’s total. The pair of Disney titles helped elevate the December global box office to $3.5 billion. This was the highest-grossing December since 2019, up double digits (+10%) against December 2024, the prior best of the decade.

Moreover, this December, the International (excluding China) and Domestic markets combined recorded the second-highest grossing month since December 2019, generating a box office of $2.95 billion in the month. That is only behind July 2023 (-13%); marginally ahead of 2025’s July (+0.3%).

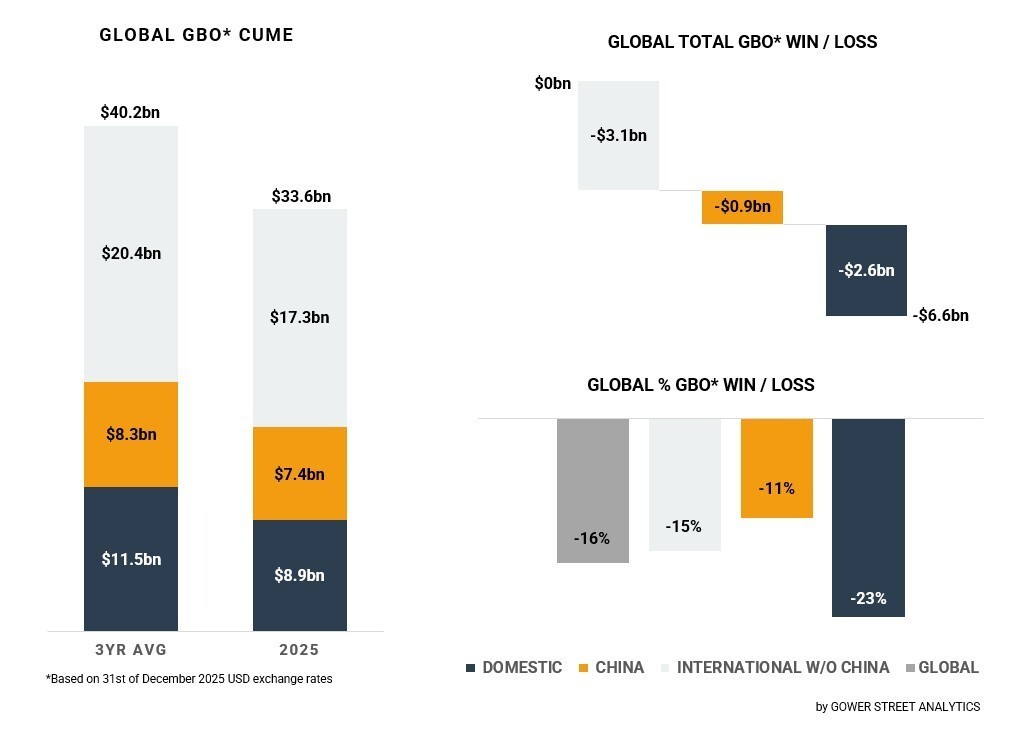

At the end of 2025, the total Global box office is estimated to have reached $33.55 billion. That is the second-highest grossing year since 2019. Only down -1% on 2023. It is +6% up on 2024 in current US$-exchange rates. A substantially strengthened dollar had challenged many major international markets severely in 2024. This has eased over 2025 and increases the year-on-year growth at historical exchange rates to +12%. Still, the 2025 global box office is significantly behind (-16%, or $6.6bn) an average of the last three pre-pandemic years (2017-2019) at current exchange rates.

International box office (excluding China)

The International box office (excluding China) had a great December. The region provided $1.96 billion to the global box office. It was the second-highest-grossing month of the decade, only behind July 2023 (-3%), when the BARBENHEIMER phenomenon reigned. Ahead of last year’s December by +7%, which was previously in that spot.

This December, er the International box office (excluding China) nearly performed on the pre-pandemic level for the month (-2%). This is the second-best value of that metric in 2025, just after September (-1%), and the fourth-best since 2019.

Adding the excellent December result, the International box office (excluding China) finished 2025 with a $17.3 billion total. That is +3% above last year and +1% on 2023. While being marginally the best of the running decade, the year was -15% below the three-year average.

Domestic

The Domestic market had a very good finish to the year. The highest grossing global market in 2025 generated $985 million in December, the #2 month of the year after July (-13%). It was also the 7th highest-grossing month of the current decade in the market. Further, it was the 2nd best December since 2019, only marginally (-1%) behind December last year. Still, this marks the 7th consecutive month that grossed less than the same month last year! Despite this, the Domestic market managed to record the 2nd best half-year of the decade, just behind the second half of 2024 (-8%).

The strong mix of movies in the market was key. Just for the third time this year, at least three titles crossed $100 million within a month. Moreover, it was only the fifth time since June 2019 that six titles grossed more than $50 million within one month: AVATAR: FIRE AND ASH at #1 with $250 million, followed by ZOOTOPIA 2 ($179m), FIVE NIGHTS AT FREDDY’S 2 ($122m), WICKED: FOR GOOD ($66m), DAVID ($59m) and THE HOUSEMAID ($56m).

Adding the December result, the Domestic market finished 2025 with a $8.87 billion total. That is -2% down on 2023 and +1% up year-on-year, which positioned the Domestic market in the middle of our top 20 tracked markets at #10. The gap to the three-year average is at -23%. Compared to the pre-pandemic average the Domestic market only ranks #14 of the tracked Top 20 major markets.

China

Like the Domestic market, another volatile year at the Chinese box office ends with a very good December result. The $529 million December box office is the 2nd best December total of the decade, just -5% behind 2023 and on par with 2020. A huge increase of +58% year-on-year. The Chinese market continued its recovery since July after contracting a bit in October, being above the same period in the prior year in four of the past five months by high double digits.

Like last month, nth the Chinese box office was dominated by non-Chinese movies. At #1, ZOOTOPIA 2 added an enormous $298 million for a $570 million total. It’s already the #2 title in the Chinese market this year. China is by far the highest-grossing single territory for the Disney sequel, nearly doubling the 2025 Domestic cume of $338 million.

ZOOTOPIA 2 is the 2nd highest grossing US-movie in China of all time, only behind AVENGERS: ENDGAME ($627m). At #2 of the December box office, AVATAR: FIRE AND ASH contributed $110 million. At #3, another local World War 2 film GEZHI TOWN generated $54 million. The first three movies combined had a commanding 87% market share!

The Chinese cume for 2025 reached $7.4 billion, which is the second best of the decade. Just -5% behind 2023. Significantly up (+21%) in 2024, the 3rd highest growth of the tracked Top 20 major markets. The gap to the pre-pandemic average was at -11%, which ranks #6 of our top 20 tracked markets.

This is harshly down from the peak of +72% at the end of February. The release of the local animation phenomenon NE ZHA 2 opened for the Chinese New Year and lifted the market’s box office to unseen heights. It’s by far the highest-grossing local title in China of all time with $2.1 billion.

More than double the second-placed THE BATTLE OF LAKE CHANGJIN ($887m). It’s the highest-grossing global title this year, despite generating just incremental $60 million outside of its country of origin. That positions it as well as the highest global grossing animated title of all-time and the #5 global release ever after TITANIC at #4 ($2.26bn). NE ZHA 2 was the defining release in China for 2025, being responsible for an astonishing 29% of the year’s box office!

Outlook

2025 was the first year since 2019, which was only indirectly influenced by the disruptive events of the COVID-19 pandemic and the Hollywood strikes. With these restrictions disappearing,g the status quo of the theatrical industrial shaped more clearly. A persistent state of transition emerged. Continuing Hollywood Studio consolidation and changed consumer habits challenged the industry. An increasingly unstable economic and political world adds further limitations on a wider scale to the growth of the theatrical industry.

While the Hollywood-driven box office is still not back to pre-pandemic strength, local productions around the world expanded their footprint further. The two biggest international markets, China and Japan, saw multiple local productions reaching record heights.

Japan was even able to export its local success. DEMON SLAYER: INFINITY CASTLE grossed over $500 million of its $779 million global total outside of its country of origin, making it the #7 release globally of the year. Opening the theatrical world to new audiences and widening the diversity of the slate for the years to come. DEMON SLAYER: INFINITY CASTLE itself is only the start of a trilogy.

That US-productions can still succeed hugely, even in markets that showed a decline of interest for them in recent years, was illustrated by the huge success of ZOOTOPIA 2 and, to a certain extent,t also that of AVATAR: FIRE AND ASH in China at the end of 2025.

Animation and Family product defined the global box office for the second year in a row. Four of the top five global grossers this year were family titles after four of the top six in 2024. Attracting families and specifically young audiences is essential for developing the future audience. Additionally, a wider and more diverse slate of movies remains a key factor for a sustainable recovery and growth of the theatrical industry.

2026 unfortunately still doesn’t look like a fully 12-month business calendar. But it offers a strong franchise-led release calendar with new instalments in massively popular franchises like SUPER MARIO BROS, STAR WARS, TOY STORY, MINIONS, SPIDER-MAN, THE HUNGER GAMES, JUMANJI, DUNE, and AVENGERS. Furthermore, her many attractive non-sequels like MI C, A, L; the live action version of MOANA, and new titles from Christopher Nolan (THE ODYSSEY) and Steven Spielberg (DISCLOSURE DAY), among many others.

While 2026 is unlikely to get near the record Global box office year 2019 ($42.3bn), it is likely to become the highest grossing global year since.